By Sonny Aragba-Akpore

When the announcement of a new broadband plan (2020-2025) was made in 2020, those of us familiar with what broadband meant began to celebrate of the life abundance for fast speeds internet connectivity on the way.

Three years after, the Nigerian Communications Commission (NCC) has continued to reel out increment of the progress recorded so far without telling us how it arrived at the figures.

Until year 2000, telecommunications operators were largely involved in reeling out figures of numbers of telecommunications subscribers connected to their networks.

But after 2001 when actual regulations of the telecommunications services began, the NCC began to have a hold on regulatory activities especially after the licensing of Mobile Network Operators (MNOs). MTN Nigeria, Econet Wireless Network and the Nigerian Mobile Telecommunications Limited (Mtel) were the pioneers of mobile communications services.

By their licensing mandates,the NCC had unfettered control of their activities, they were simply operating under Decree 75 of 1992 which set up the NCC but by the advent of the Nigerian Communications Act 2003, the NCC had become very independent and empowered to carry out proper regulation of the telecommunications services.

The NIgerian Communications Act 2003, lost meaning for the sector between 2019 and May 28, 2023 during the reign of terror of a powerful Minister.The NCC and its managers were boxed to a corner and close to the cliff. Regulatory activities were taken over by that Minister and the buck ended on his table. He annexed the Universal Service Provision Fund ((USPF) and changed the nomenclature from what was previously known. He named his crony Executive Secretary and did a working paper to President Muhammadu Buhari that the Executive Secretary should remain so until he is retired.

But the Minister forgot the way of mortals.

Less than a month after he left office, that same Executive Secretary that he got a blackmarket approval for was removed and redeployed by the same NCC that he had held on its jugular.

It’s managers led by Professor Umar Garba Danbatta found their steam once again.

The Professor has been on a strange advocacy lately perhaps to impress Bosun Tijani that he the Professor has capacity for the job and he is ready to complete his tenure in a grand style in another two years.

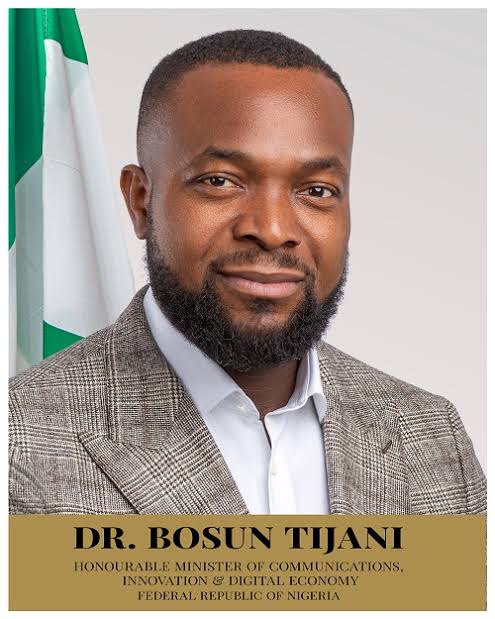

Tijani is not so naive to be carried away by cosmetic displays, especially when the industry that he has come to manage by his appointment as Minister has known better years until 2019 when the star agency was taken over by rudderless player posturing as a game changer. That Minister has gone and like English poet, Alfred Lord Tennyson tells us, ”authority forgets a dying king“. Tijani is the new kid on the block.

Danbatta took his advocacy to Kano his home state at the weekend and announced to a bewildered audience that the country had achieved 47% broadband penetration but did not say how we got there. It’s curious how figures are churned out with no explanation as to how these figures emanated. Statistics are supposed to be scientifically arrived at but not so for this broadband matter. From the beginning of this broadband scenario, figures and figures were churned out. How did we know how and who has access to broadband even when figures like 89million are allocated to broadband connectivity?

At least with my experience and encounters with the system and some of its workings, I find it uncomfortable to agree with certain decisions and positions of the commission.

If we agree with the International Telecommunications Union (ITU) teledensity template, it’s inadmissible to believe Danbatta’s figures on the broadband penetration.

How many MNOs have fourth generation (4G) and 5G connectivity and how do we gauge the number of subscribers thereto?.

Globacom Limited,owners of GloMobile got a Second Network Operator(SNO) license in 2003 but has since abandoned the fixed line component of the license and the NCC looks the other way.

So apart from 21st Century Technology, IPNX, Broadband Connectivity, VGC Communications(MTN), Spectranet and a few others, how many companies address fixed lines connectivity to boost the so-called broadband connectivity which NCC says will hit 70% by 2025, especially when regulatory activities are now alien to the industry?

Last week, it approved the transfer of a 10MHz spectrum in the 2.6GHz spectrum band from OPENSKYS Services Limited (OS) to MTN Nigeria.

A statement from MTN, said the licence took effect on September 7, 2023, and will see MTN deploy the spectrum across the 36 states of the federation, including the FCT. Maybe this will boost broadband connectivity.

The 2.6GHz spectrum band is designated for the deployment of terrestrial mobile broadband services. According to a GSMA report on opportunities for global mobile broadband, the 2.6GHz spectrum band is the ideal complement to the 700MHz-800MHz spectrum bands as together, these bands can help to provide the most cost-effective nationwide coverage of mobile broadband services across both rural and urban areas.

By NCC figures, broadband penetration in Nigeria stood at 47.36 per cent as at December 2022. The Federal Government of Nigeria has a target of 70 per cent broadband penetration by 2025.

MTN Nigeria’s acquisition of the broadband spectrum will enable the ICT giant to provide improved broadband services for its customers, meeting the rapidly growing demand for capacity to deliver mobile broadband services on a widespread, common basis across the country.

MTN says ”the transfer of the spectrum will significantly improve its customers’ experience in line with its commitment to deliver excellent service. In addition, the acquired spectrum will also enable the telecommunications operator to deliver broadband technologies, aiding the achievement of Nigeria’s broadband objective.”

Karl Toriola, Chief Executive Officer, MTN Nigeria said, “This additional spectrum will enable us to deliver on our promise to our customers to deliver quality service, as we continue to support the Federal Government’s vision of deepening broadband penetration in the country.”

A report by the GSMA suggests that an increase in broadband penetration especially in developing countries automatically translates to an increase in Gross Domestic Product (GDP) and this underscores the need for constant development and investment in broadband infrastructure such as the 2.6GHz spectrum band.

Danbatta’s advocacy in Kano reviewed five-pillar Strategic Vision Plan as building block, and spoke to 119 milestones achieved under the five strategic pillars, including regulatory excellence, universal broadband, market development, digital economy and strategic collaboration.

He said through effective implementation of NCC’s mandates under his leadership and cooperation of internal and external stakeholders since 2015, telecommunications industry in Nigeria has achieved remarkable milestones under our leadership. “While we acknowledge the challenges encountered by the industry, we have also witnessed explosive growth, improved regulatory standards, and digital innovations that have garnered global recognition,” he said.

While reeling out impressive statistics that have characterized his leadership at NCC from 2015 to date, the EVC said active telephone subscribers had increased from less than 150.7 million to 218.9 million, representing a teledensity growth of 115.70 per cent from 107.87 per cent in 2015.

Through stimulating broadband infrastructure across the country, Danbatta said broadband penetration, which stood at 6 per cent in 2015 has increased significantly to 47.01 per cent as of July, 2023, enhancing over 89.73 million subscriptions on 3G, 4G and 5G networks in the country. Additionally, general Internet subscriptions have reached 159.5 million up from less than 100 million in 2015.

“Also, from 8 per cent contribution to the Gross Domestic Product (GDP) in 2015, telecommunications sector now contributes 16 per cent quarterly to the Nigerian economy as of the second quarter of 2023. besides, following the authorization of more telecommunications companies to operate in the Nigeria’s telecoms sector, the investments profile has increased tremendously from $38 billion in 2015 to $75 billion currently and this keeps growing daily. From the sales of Fifth Generation (5G) C-Band Spectrum, the NCC has generated over $847.8 million for the Federal Government,” he said.

“The number of connected telephone lines in Nigeria has risen to 325 million as of February 2023. Additional nine million lines were registered by tele-coms operators between December 2022 and February 2023 as the number grew from 316 million at the end of last year to 325 million as of February this year. Statistics from the Nigerian Communications Commission (NCC) revealed that operators activated additional 953,192 Subscriber Identity Module (SIM) cards in February to increase the number of active telephone lines in the country to 226.8 million out of 325 million connected lines. It was 225.8 million in January, 2023.”

He said as at the end of 2022, the number of active lines was 22.2 million out of the total 316 million connected lines. The active lines increased to 226 million in January, 2023 and 226.8 million in February of the same year. This newly released industry statistics by the NCC revealed further that the country’s teledensity also increased by 0.5 per cent, from 118.51 per cent in January with total subscriptions of 226,226,754 to 119.01 per cent by the end of February with 227,179,946 subscriptions. The number of subscriptions as of December, 2022 was 222,571,568 while teledensity was put at 116.60per cent. Teledensity is the number of active telephone connections per 100 inhabitants living within an area.

The 226.8 million, according to NCC, were a combination of services from GSM, Fixed Wired/ Wireless and Voice over Internet Protocol (VoIP). As of January, penetration on these gateways showed that Mobile (GSM) has 99.84 per cent penetration; Fixed Wired 0.05 per cent and VoIP 0.12 per cent. Internet subscriptions on the narrow band leaped by the addition of 745,703, moving from 155.6 million in January to 156.4 mil- lion a month after, with Internet Service Providers only able to service 204,810 customers in the country. The analysis of the data showed that MTN maintained its leadership of the telecoms market, whose worth is put at excess of $75 billion. Specifically, MTN with 92.71 million mobile subscriptions, enjoys 40.87 per cent market reach; followed by Airtel with 60.7 million users and 26.78 per cent penetration.

Danbatta said other consumer-focused initiatives of the Commission have also centered on the establishment of Emergency Communications Centres (ECCs) in over 30 States of the Federation and the Federal Capital Territory (FCT). All these centres are operational, as well as the creation of the Computer Security Incident Response Team (CSIRT). The EVC said these two initiatives have been helping consumers to get succour in times of emergencies as well as ensuring effective protection for telecom consumers while online.

The NCC Chief said the Commission has also taken very clear actions on consumer protection, advocacy, information-sharing and education. “These include introduction of data roll-over just before the expiration of subscribed data plans, introduction of the 622 toll-free number for lodging service-related complaints to the Commission, the Do-Not-Disturb (DND) 2442 Short Code for tackling the menace of unsolicited text messages, elimination of forceful/deceitful subscriptions to telecom services on mobile networks, tackling the issue of call masking, ensuring effective Subscriber Identity Module (SIM) registration, launching of National Roaming service and reduction of access gaps to telecom services from over 217 to 97, thereby enhancing access to telecom services by more Nigerians,” Danbatta said.

However, Danbatta said while the industry still faces a number of challenges such as vandalism, securing equitable Right of Way (RoW) from governmental stakeholders, as well as multiple taxation and regulation, the Commission has put framework in place to work with necessary stakeholders to overcome the obstacles possed by these challenges and to sustain the growth trajectory which has been the hallmark of telecoms sector as an enabler of socio-economic development in Nigeria.

Apart from reeling out figures and more figures to justify its achievements, how do we gauge regulatory activities of the commission, especially in the last four years without necessarily looking at grandstanding as a lifestyle?

Playing to the gallery is not going to help the sector as service providers and consumers are eager to get the value for their money both as investors and consumers.

▪︎ Aragba-Akpore, a telecoms trend analyst, lives in Abuja and sent this via WhatsApp.